Understanding Banking

In a team of two designers, at the Design Consultancy Services of National Institute of Design, I worked on the primary and secondary research, workflow, along with user experience and interface of a corporate banking application.

Location

AHMEDABAD, GUJarat, India

role

Researcher + Information designer

The CHallenge

Redesign a corporate banking app to encourage users build a relationship through transactions.

The project aimed to be a redesign of User Interface. The cumulative design brief would be described as an attempt to improve the current corporate banking application, with increased services and visual simplicity. The client being one of the best in their field, wanted to provide new and better facilities and incentives to their users. Using applications to make your daily life effortless and interesting is not new to people, but using it to make big decisions and exhausting the medium is what we need.

This project was to provide the best one can get, from a banking applications. Client wanted to break rules and try to aim at a better future, where we save time, energy and resources.

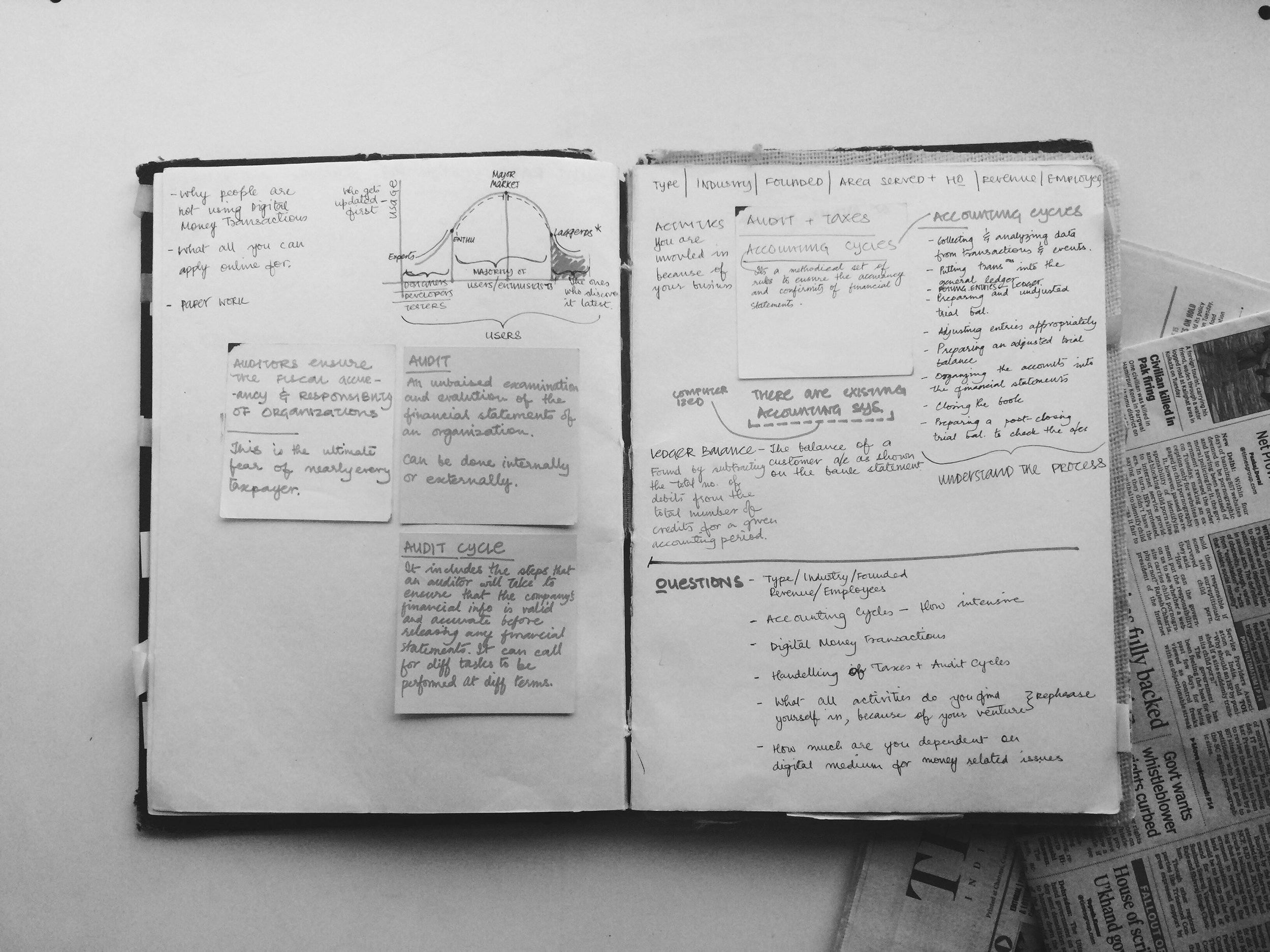

Left: BANKING BUSINESS MODEL: A bank can generate revenue in a variety of different ways including interest, transaction fees and financial advice. The main method is via charging interest on the capital it lends out to customers. The bank profits from the difference between the level of interest it pays for deposits and other sources of funds, and the level of interest it charges in its lending activities.

Right: MOBILE BANKING MODEL: Mobile banking refers to provision and availability of banking and financial services with the help of mobile telecommunication devices. The scope of offered services may include facilities to conduct bank and stock market transactions, to administer accounts and to access customized information.

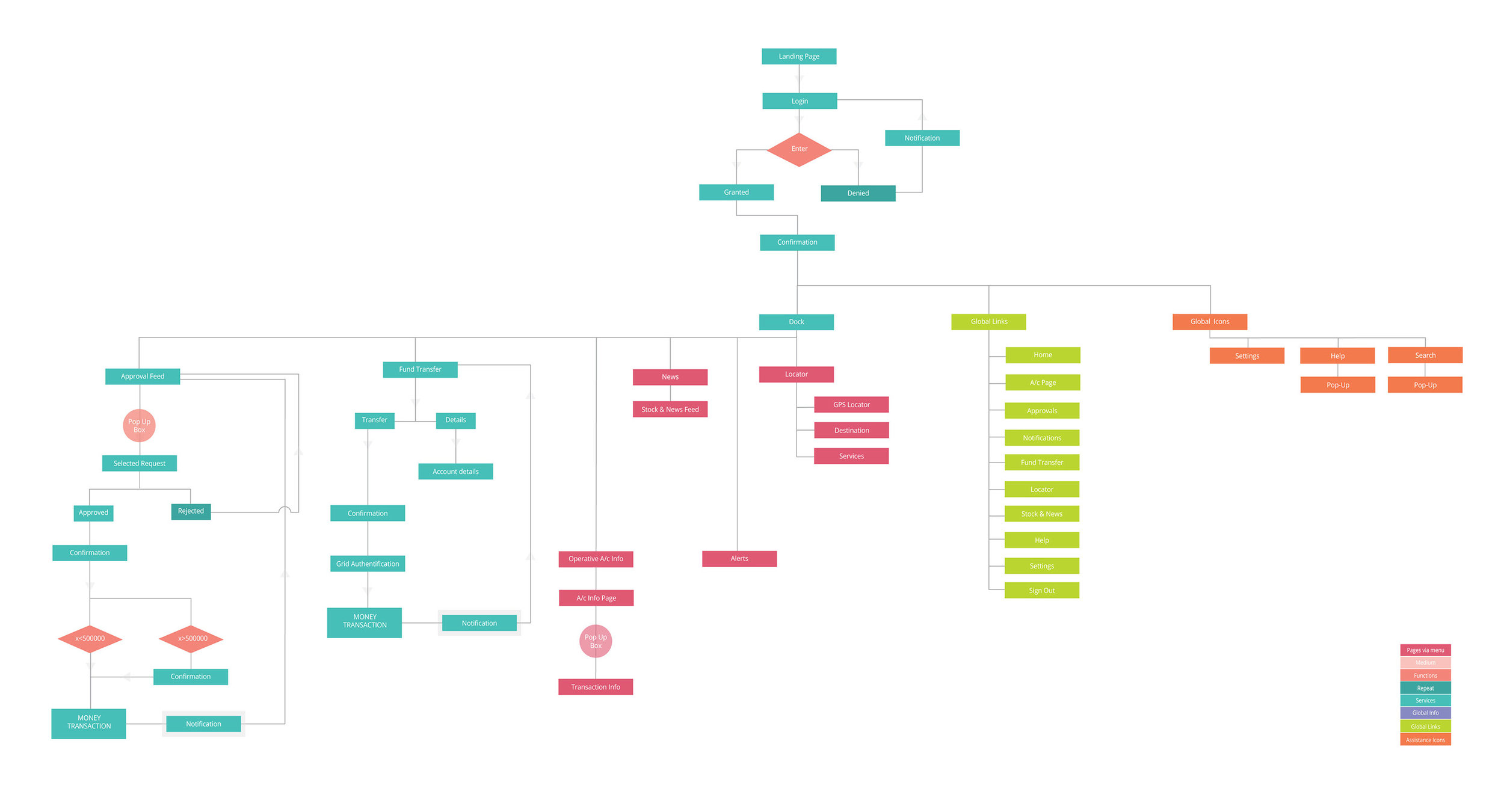

CHAIN OF OPERATIONS

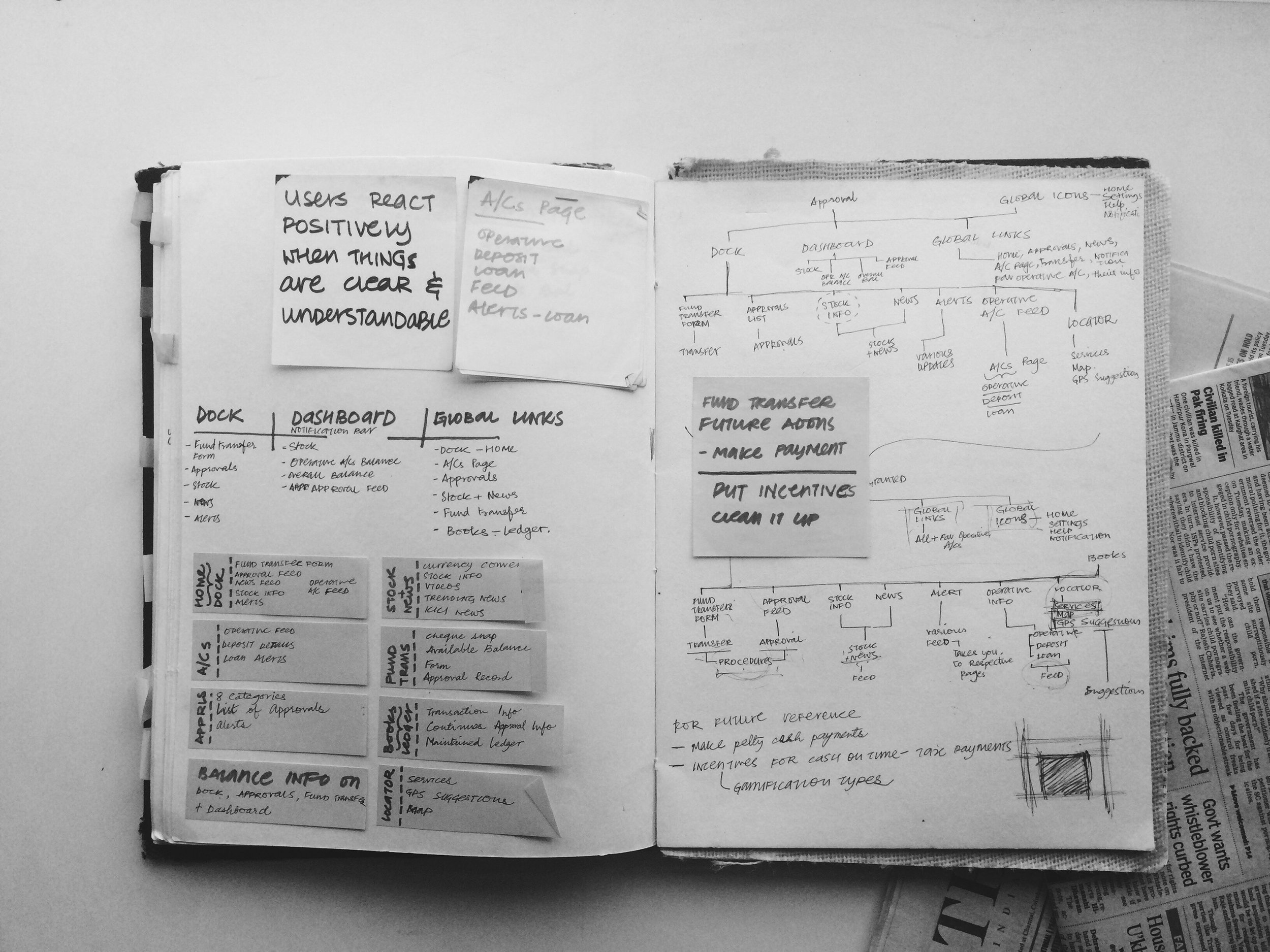

This application will be used by a varied audience, which ranges from proprietors to accountants of large corporations. The task flow in this case becomes integral because as the number of people increase, so do the issues of adaptability and flexibility. It’s also important to understand that the user will have to go through the same kind of information on a daily basis and the system should reduce mistakes and overlapping. The reason of less financial applications usage is because of the high level anxiousness, and hesitation due to large amount of money. This is one of biggest issues of these types of applications and it was one of the core points, which had to be addressed.

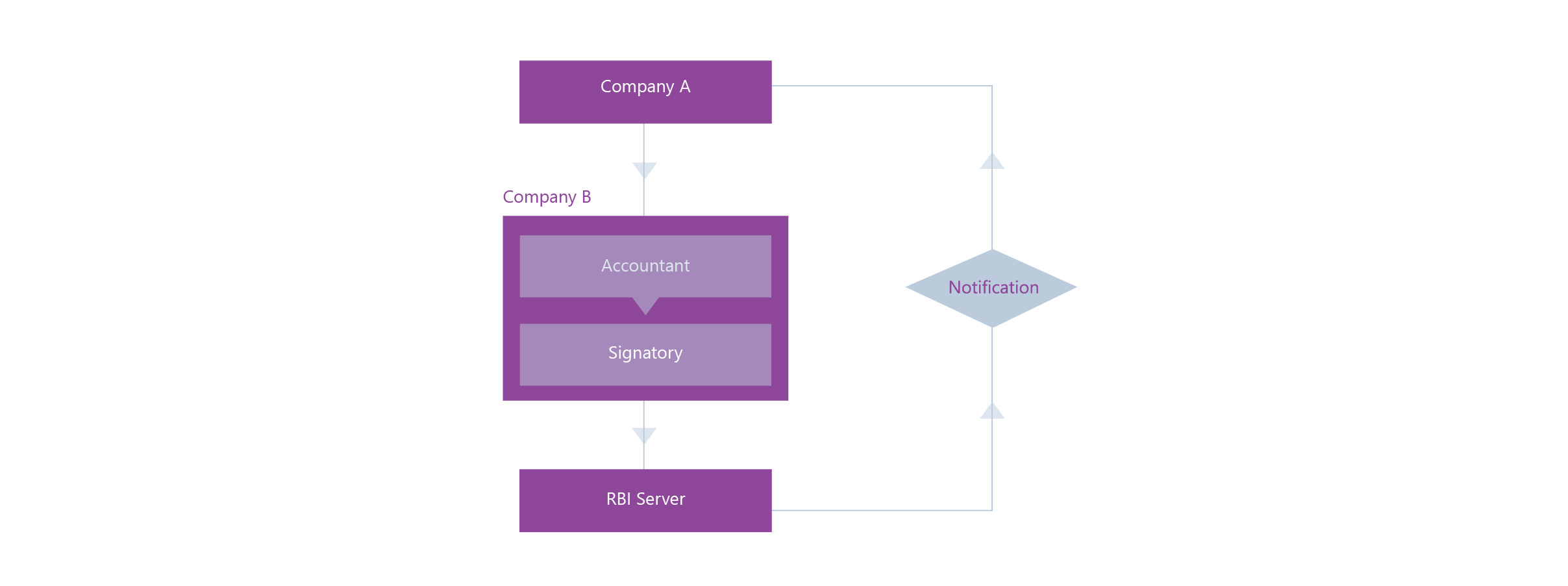

In a regular situation, an owner or accountant will send a request to another company or user, which in turn is received by the accounts team on the other end, Company B. It is necessary to understand the text and the request must be checked by the accountants in this case and then sent to the authorised signatory. They, then approve the same from their end, which may or may not be checked at this point. Then the request is taken to the RBI server, from where the money gets transferred and then the point A gets a notification of the same. In the scenario mentioned here, there are 4-5 different key points, depending on the number of authorised signatories one has, and size & type of the venture/ organisation. With such heavy duty surveillance, one needs to simplify the gestures and transitions and keep it minimal

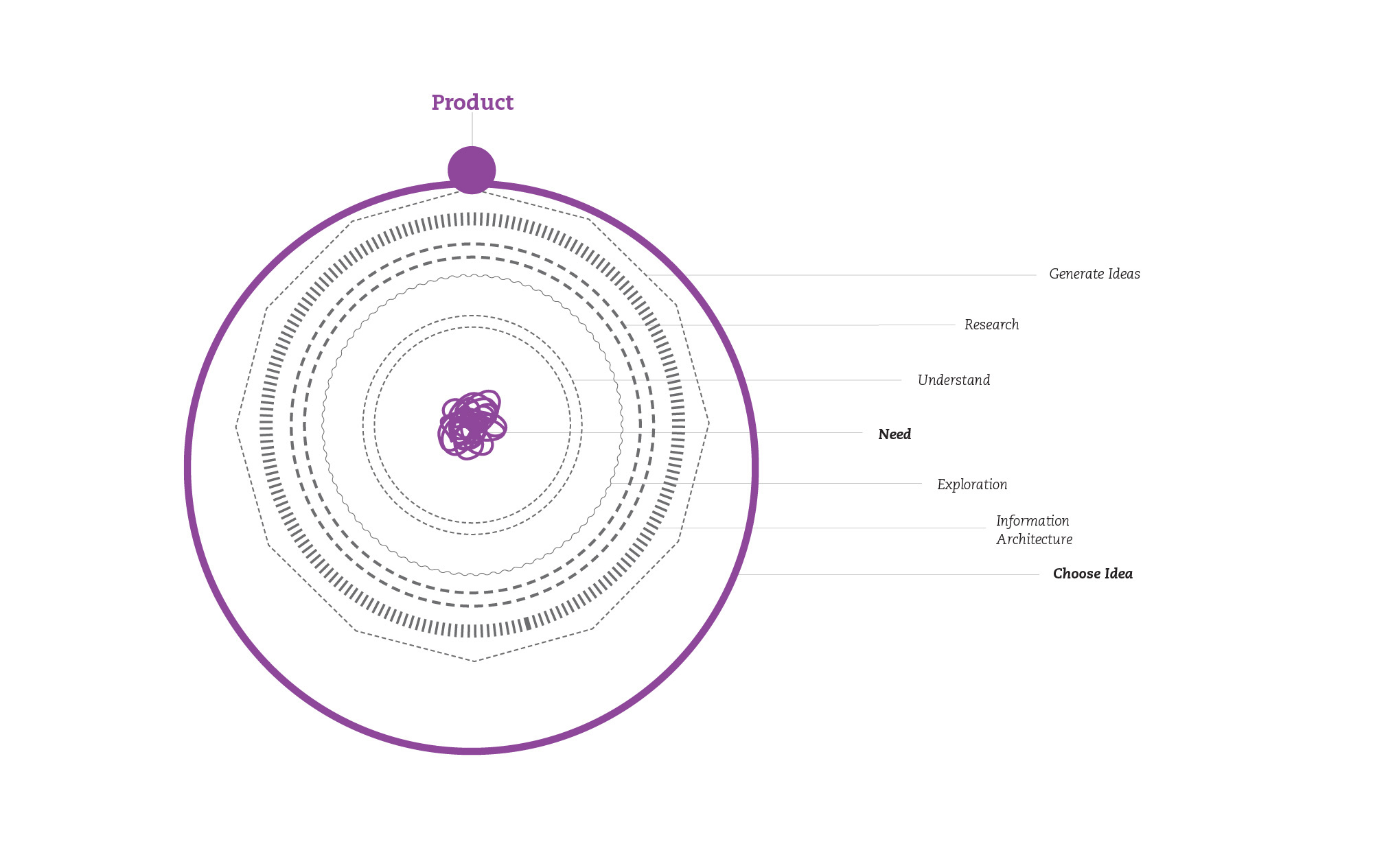

DESIGN PROCESS

NID has its own way of design thinking and looking at problems from different perspectives. The process and outcome need to justify your dedication to the project. Especially in NID, process is given more attention and every single detail at the back end needs to be attended to. Students and designers in NID are encouraged to look for questions and then answer them with the help of the process. In this project the same attitude was represented, each and every detail gave birth to new questions and with a step further they were answered. The process was mainly dependent on the learning. The process was started from scratch and taken forward as questions arrived and solutions didn’t. The outcome was a result of a journey through various kinds of questions and finding their answers. The detailed process is based on every factor that affects the process of a design to come into being.

After reading and compiling the data, there were few things which needed attention immediately and the priority of the project happened to change over the period of time. Now it was not just an application redesign, since it was a banking application it was necessary to understand the anxiety spots of the user and fix them first. And the variety of clients added more complexity. We had to cater to each and every one, with the least number of communication problems. It was essential to understand how to use minimum input from the users’ side, and still provide a worthwhile experience. A banking product is generally dull and confuses users due to graphical and system errors, which the company finds difficult to solve each and every time. Through this project the small communication gap could be solved, and as one user mentioned, a good service is incentive enough.

As a result, we built an app that informed the user about market trends, their daily transactions, and help them maintain their corporate relationships.